B2B sales closing and financing platform Vartana raises $12M • TechCrunch

The software-as-a-service (SaaS) industry is facing budget constraints and reductions in headcount as a result of the pandemic and the broader slowdown in tech. Companies have tightened up their budgets for SaaS purchases, looking to keep cash on hand while growing more efficiently.

That’s why Kush Kella and Ahmed Sharif founded Vartana (which my colleague Mary covered recently). While working together at fleet management company Motive, Kella and Sharif say they dealt with the pains and problems caused by broken SaaS contract management and rigid payment infrastructure. After years watching deals falls through due to a lack of payment flexibility, they left Motive to build Vartana, aiming to equip companies with a managed platform that helps sales reps close deals.

“Vartana is a win-win for sellers and buyers of SaaS services and hardware products,” Kella told TechCrunch in an email interview. “It gives vendors new tools to close contracts and generate cash with prepaid deals while offering buyers various payment options and a simplified purchasing experience, ensuring buyers are able to purchase the best technology available to grow their business.”

Vartana today announced that it raised $12 million in a Series A round led by Mayfield with participation from Xerox Ventures, Flex Capital and Audacious Ventures., bringing its total raised to $19 million. Vartana also secured a $50 million line of credit from i80 Group, which Kella says will ensure financed deals can be managed through Vartana’s new capital marketplace.

“With the launch of the Vartana’s capital marketplace, Vartana no longer holds buyer debt in their books, ensuring a balance sheet-light business,” Kella said. “We’re focused on lean, effective growth. We’ve found strong success in the SaaS industry and we’re doubling down.”

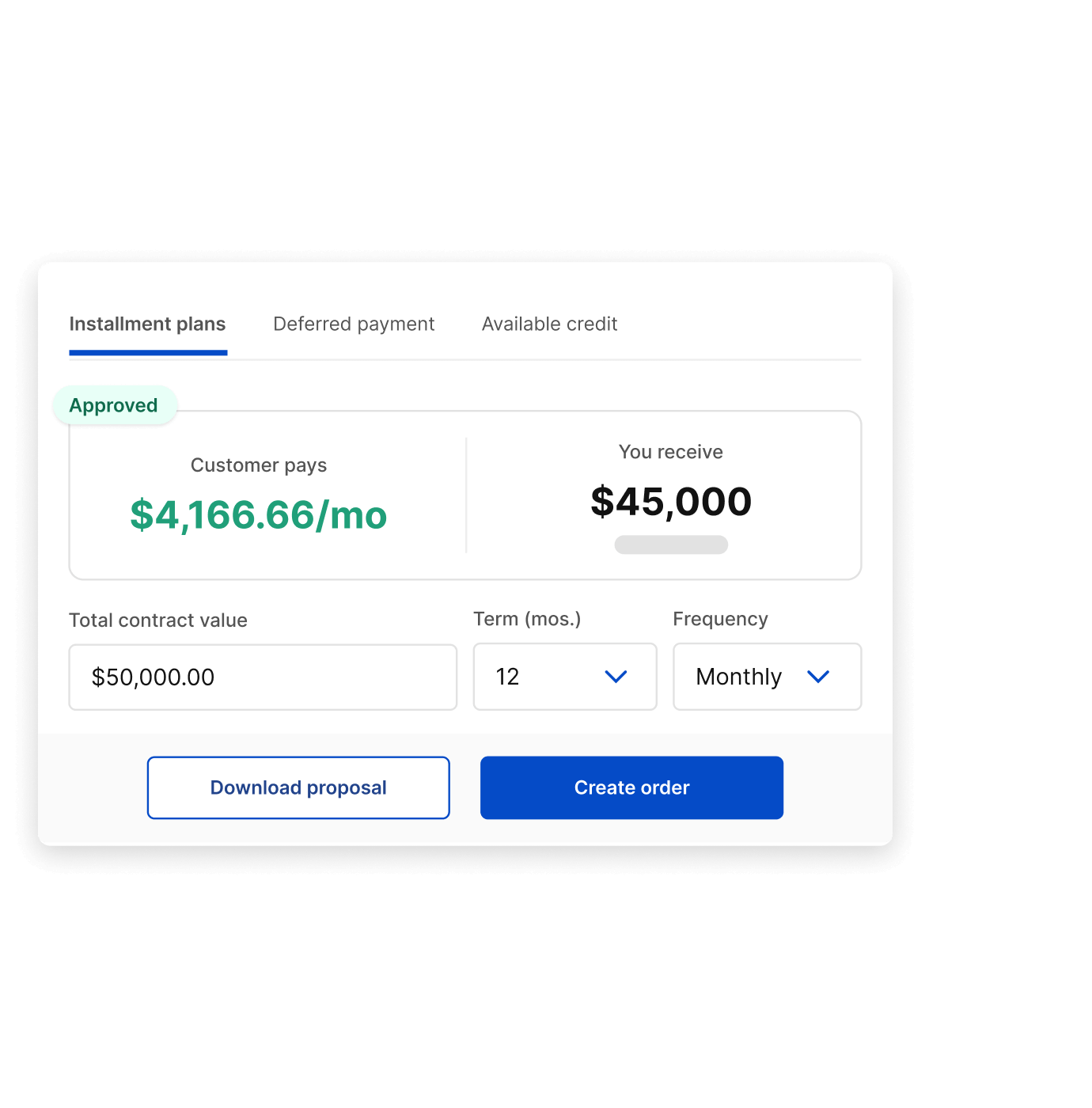

Vartana’s platform, which Kella refers to as a “sales closing” platform, is designed to be used by sellers of business-to-business software, hardware and hardware paired with SaaS software. Vartana helps to manage tasks like contract tracking, payment terms and signature capture, accepting a range of different payment options (e.g., pay in full, deferred payment) and installment plans. Sellers can send multiple quotes at one time and give buyers the flexibility to select which payment style works for them. Once payment has been selected, the buyer can e-sign the agreement from the web or mobile, finalizing the deal.

Image Credits: Vartana

On the capital marketplace side, Vartana-developed algorithms normalize data, rate each buyer and extend debt financing offers. The platform matches buyer loan requests to a network of banks and lenders, allowing buyers to request funds and receive quotes in real time.

“When deals are financed, either traditionally through a bank or via the Vartana platform, sellers get paid on day one,” Kella said. “New non-dilutive cash flow is acquired for the entirety of a deal, sometimes up to five years of future cash, and buyers don’t have to pay upfront, meaning they get to keep cash in their bank account and pay a monthly fee, ensuring they stay nimble and can invest cash in the areas of their business that need it most.”

Kella sees Vartana — which works with “dozens” of sales departments at companies like Verkada, Samsara and Motive and over 10,000 buyers, he claims — as competing with startups including Ratio, Cashflow and Gynger. Ratio has been particularly successful as of late, bagging $411 million in equity and credit last September. But he doesn’t see them as direct competitors, pointing out that Vartana’s model hinges on delivering financing to buyers and targeting late-stage tech companies.

On the subject, Vartana recently launched a closing platform that enables sales reps to “market” financing and deferred payments to any buyer. “This is particularly important in a world where cash is king and companies are looking for ways to keep cash on hand,” Kella explained. “Providing self-serve financing as an option to all buyers helps buyers keep hold of cash and pay for products over time while sellers get access to full contract value on day one.”

Kella didn’t answer a question about Vartana’s revenue. But he said that financing volume grew 600% year-over-year while the company’s headcount grew 4x. The plan is to increase the size of the workforce further from 40 employees to 85 by the end of 2023.

Patrick Sayler, a Mayfield partner and a Vartana investor, added via email: “In business-to-business enterprise software, time kills all deals. This is especially true in the deal closing process, where there is a shocking amount of offline back and forth between vendor, buyer and financing teams that takes weeks and causes deals to push to the next quarter or die all together. Vartana’s business-to-business enterprise sales closing and financing platform brings this to an end with a fully digital checkout platform with integrated proposals, signatures, payments and self service financing, improving conversion, sales cycles, order values and managing cashflow, obviously critical for the current economy.”