Getsafe expands to France starting with home insurance • TechCrunch

German insurtech startup Getsafe is adding a fourth market with today’s product launch. In addition to Germany, Austria and the U.K., Getsafe is now going to offer insurance products in France. The company will first offer a home insurance product.

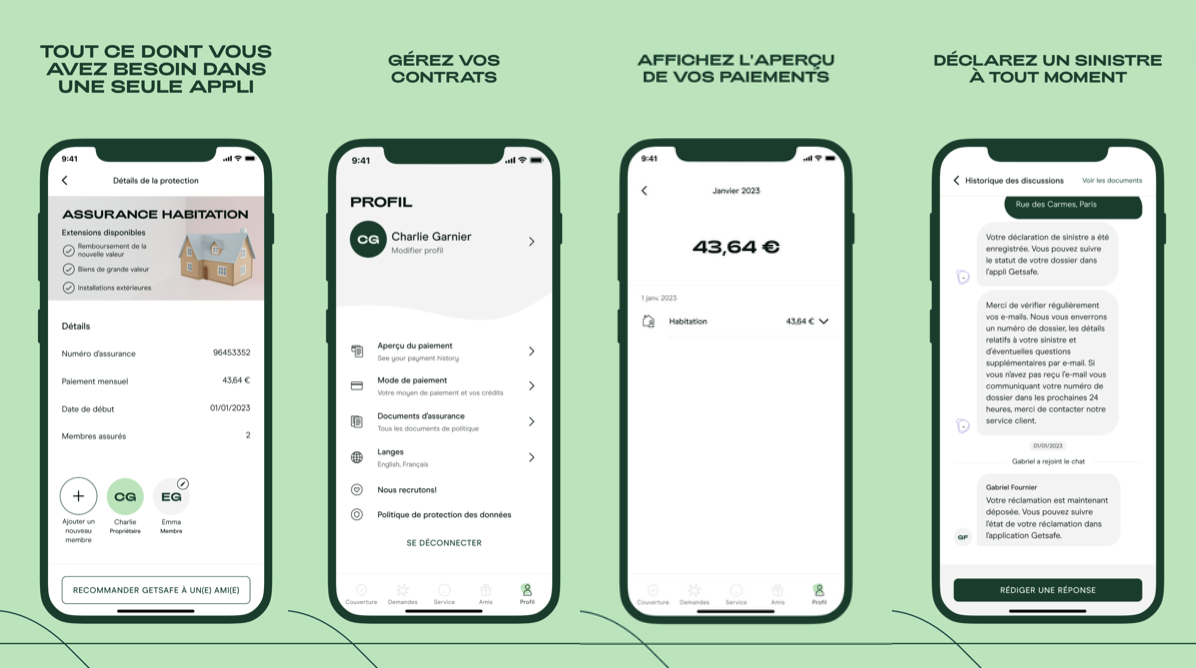

Getsafe is trying to disrupt the insurance market with a focus on digital-first insurance products. It sells its products directly to end customers through its website and app unlike its German rival Wefox.

In its home market, Getsafe originally started with a home contents insurance product. But it has greatly diversified its lineup of products with the addition of private health insurance, drone liability insurance, pet health insurance and even some financial products like private pension plans.

In October 2021, when the company announced a Series B extension of $63 million, Getsafe had 250,000 customers. It now has 400,000 clients as it is about to accept new customers in France. Getsafe has its own insurance license from Germany’s financial regulator, BaFin.

On the French market, the company is going to offer an all-in-one home insurance product. This kind of insurance products is particularly popular in France as home insurance is a legal requirement whether you own or you’re renting your home. It usually protects the house or apartment against fires or water damages as well as the contents of your home. It also includes home liability insurance.

It’s going to be interesting to see if Getsafe manages to capture some market share as this is a crowded market. All legacy insurance companies offer home insurance products and still represent the majority of contracts. When it comes to newcomers, French startup Luko also started with home insurance and now has 400,000 customers. Last year, Luko acquired Coya, a German competitor. In other words, Getsafe and Luko now both operate in Germany and France.

Lemonade, the publicly traded American insurtech, also launched its renters insurance in France. While Lemonade performed quite well on the stock market after its initial public offering, its shares dropped quite dramatically in late 2021 and 2022. The company’s market capitalization is now just above the $1 billion mark.

Lemonade’s performance could have a chilling effect on the insurtech startup market. But that doesn’t seem to stop Getsafe as the company already plans to launch more products on the French market thanks to its digital-first approach and direct-to-consumer distribution strategy. You can expect a private health insurance product, some travel insurance offerings or pet health insurance plans by the end of 2023.

Image Credits: Getsafe

/cdn.vox-cdn.com/uploads/chorus_asset/file/25547483/SDCCTrailer_FrameGrabs_Galadriel_01.jpg)