Seyna adds claim management product for insurance brokers • TechCrunch

French startup Seyna is slowly building an all-in-one platform for insurance brokers so that they can create, sell and manage insurance products from scratch. And the company is launching a new product called Seyna Claims. As the name suggests, Seyna Claims empowers insurance brokers so that they can handle claims themselves.

Seyna is an insurtech startup that has obtained an insurance license from the French regulator (ACPR). The company has created a core insurance system, which means that it can quickly generate insurance policies with different clauses so that brokers can find the right balance between coverage and price. The startup has raise €47 million since its inception.

Some companies working with Seyna include Dalma, a pet insurance startup, or Garantme, an unpaid rent insurance company. Seyna clients can build a subscription funnel with real-time quotes, generate contracts and invoices on the fly, and more.

In addition to Seyna’s own balance sheet, the company also partners with big reinsurance companies like Swiss Re, Scor or Munich Re. Some companies also have an existing relationship with insurance companies so they only use Seyna’s tech platform.

While brokers can now do a lot of things, they often have to rely on a third-party claim management companies. Those companies pick up the phone, check whether an incident is covered by the policy and analyze documents. They also take a cut on insurance premiums.

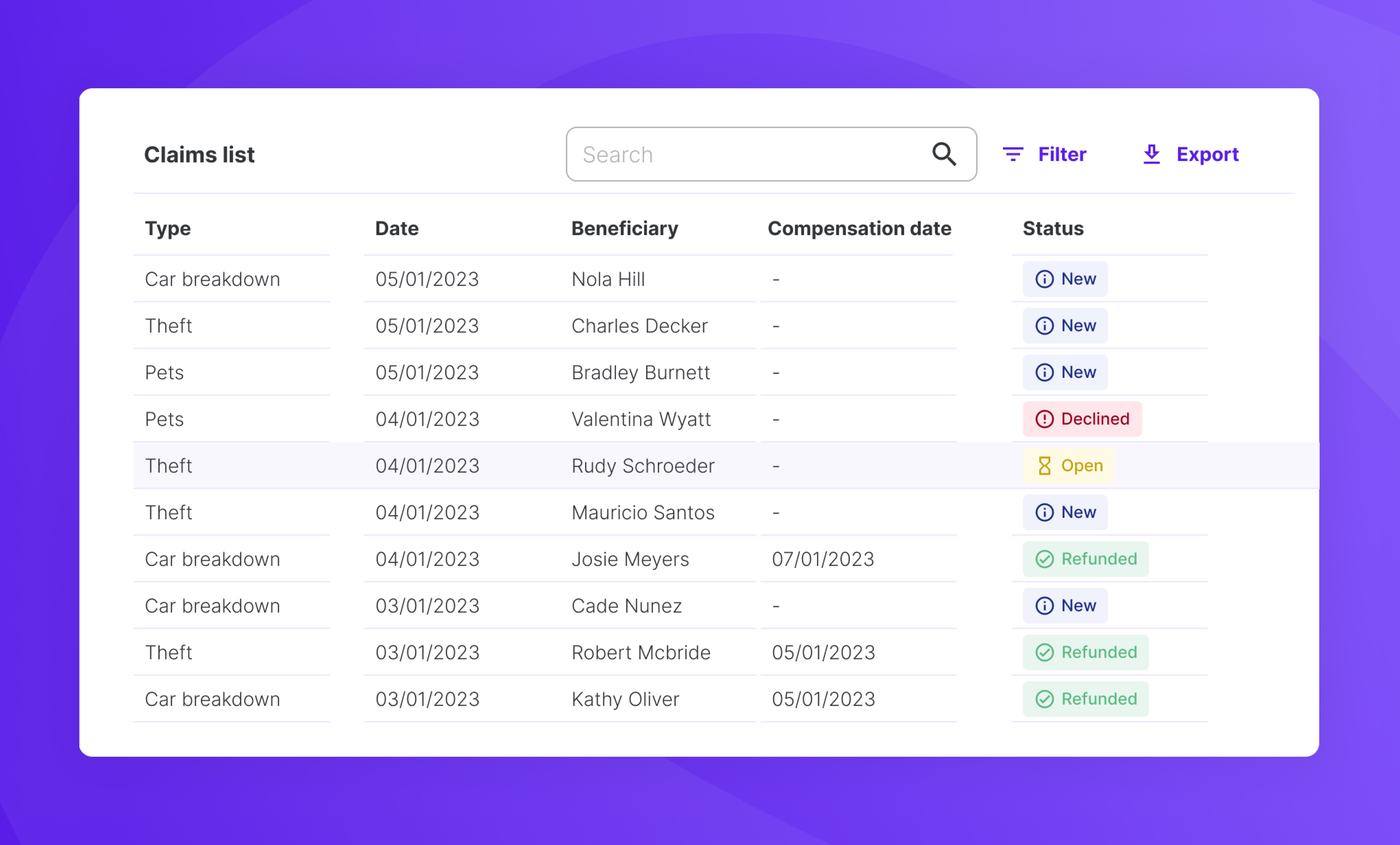

With Seyna Claims, many insurance brokers will be able to handle those pesky tasks directly. It’s a software-as-a-service product with a white-label interface that should cost less than working with a claim management partner.

Unlike other broker platforms, such as Courtigo and Sydia, Seyna isn’t just an administrative tool. It integrates with the rest of the Seyna insurance platform. For example, claim data can directly enrich the accounting tab that shows how your insurance products are doing.

In the future, the startup hopes it can enable third-party integrations in Seyna Claims to augment the product’s potential. For instance, Seyna could offer integrations with Shift Technology for fraud detection, Stripe or MangoPay for payouts with integrated KYC features, etc.

Insurance companies can also choose to use Seyna Claims independently from the rest of the Seyna platform. The startup wants to build a modular platform so that the insurance industry can pick and choose some Seyna products if they think they can be relevant to improve their operations. Essentially, Seyna is trying to modernize the insurance tech stack.

Image Credits: Seyna